- #PROFORMA INVOICE SOFTWARE FREE DOWNLOAD HOW TO#

- #PROFORMA INVOICE SOFTWARE FREE DOWNLOAD PDF#

- #PROFORMA INVOICE SOFTWARE FREE DOWNLOAD PRO#

- #PROFORMA INVOICE SOFTWARE FREE DOWNLOAD PROFESSIONAL#

- #PROFORMA INVOICE SOFTWARE FREE DOWNLOAD DOWNLOAD#

#PROFORMA INVOICE SOFTWARE FREE DOWNLOAD DOWNLOAD#

#PROFORMA INVOICE SOFTWARE FREE DOWNLOAD HOW TO#

How to use the Proforma Invoice Templateįollow these instructions to get started with our free proforma invoice template:

The template will automatically calculate the VAT. It allows you to set up a template to include your business information and logo. Our free Excel Proforma invoice template is available to download at the end of this article. If a business uses the VAT cash accounting scheme, it can only claim the VAT when money is paid or received. It is also essential to reclaim VAT in the correct period and the date the transaction took place as a customer. You must issue VAT invoices within 30 days of the date the transaction took place. You should not delay the invoice until payment is received, as it might be a couple of months later. Once a transaction takes place, a VAT invoice should be issued and include the tax date. A proforma invoice is issued on 15 th January and goods are supplied on 1 st February.The tax point is 20 th February, and a tax invoice is issued. A proforma invoice is issued on 15 th January and payment is received on 20 th February.The tax point can also be the date that payment is received. The date might be when the goods are supplied or collected, or service is complete. The tax point on an invoice is the date that a transaction takes place. Mark the document clearly with the wording “This is not a VAT invoice.” Can you Claim VAT on a Proforma Invoice? One thing to note about a proforma invoice is that it is not a VAT invoice. The customer is a bad payer, and therefore credit is no longer grantedĪ proforma invoice is a payment request, and once the customer makes the payment or the goods or services provided, you should issue a VAT invoice.It is a large order, and you require part payment upfront.The customer is new, and you require payment in advance.There are a few reasons you may decide to issue proforma invoices. What is a Proforma InvoiceĪ proforma invoice is a document issued to a customer for goods or services before you supply them. Before we get to the template, we will look at what a proforma invoice is and VAT implications.Ī proforma invoice is different from a standard sales invoice issued to a customer for several reasons. All our templates are free and easy to use. If this is the case, you can use our free proforma invoice template as a sample or starting point of creating your own template.We have created a free Excel proforma invoice template to download. While the invoice template is designed to meet the requirements of many business types, you may need a different format. To adjust this, use the Page Setup dialog box in Excel.

#PROFORMA INVOICE SOFTWARE FREE DOWNLOAD PRO#

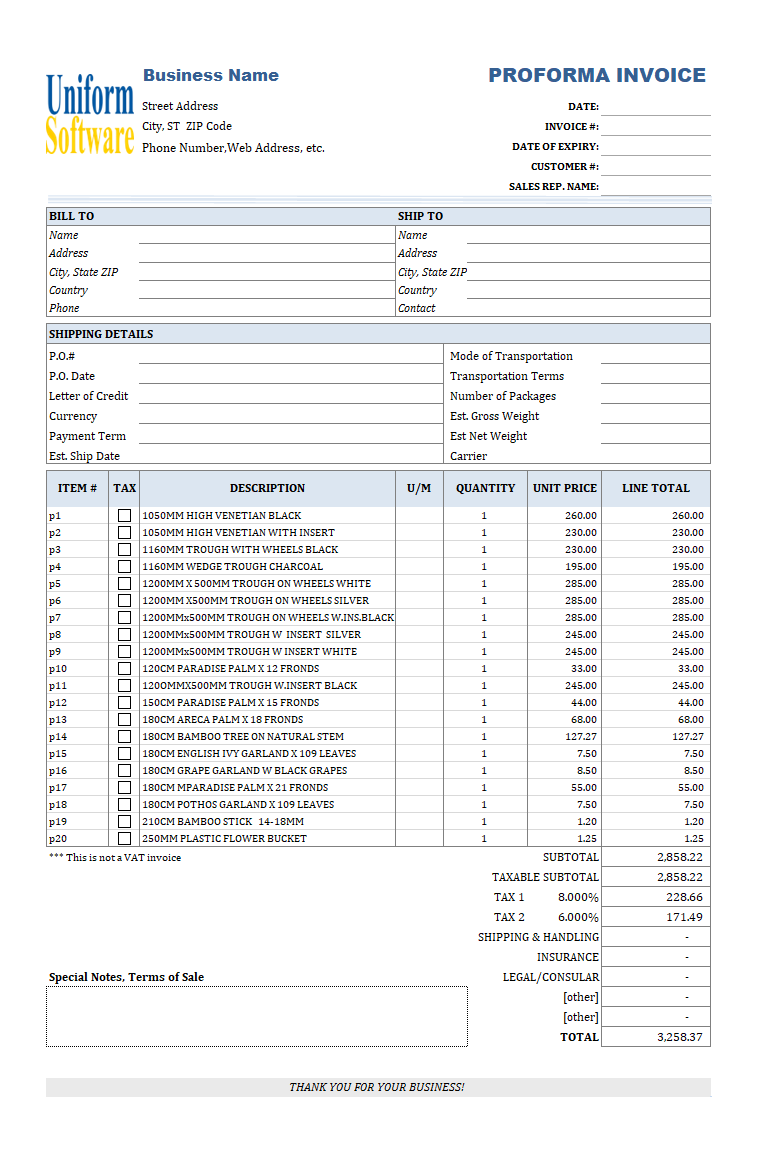

The pro forma invoice form is printable with standard A4 paper size. Many newly added fields are related to shipping and handing, since a pro forma invoice is a common form used in both domestic, and most commonly in international trade, to provide buyers as well as in the event of international trade the appropriate import/export authorities, where additional details may be required for customs, with required information about shipment. One interesting point on the pro forma invoice form is that it added many new fields as compared to a general sales invoice template designed by us at Uniform Software, such as 'purchase order date', ''mode of transportation', 'transportation term', 'estimated gross weight', 'estimated net weight', etc.

#PROFORMA INVOICE SOFTWARE FREE DOWNLOAD PDF#

The spreadsheet is in Excel format, which means you can use various Excel tools to do further customizations, such as replacing the default logo image, adjust fonts, colors, borders, patterns, and even create PDF documents by using a free PDF add-in program. Uniform Software's free proforma invoice template includes various fields for detailing the transaction between your business and your customer. Pro forma invoices are used by a wide variety of businesses in virtually all industries. A pro forma invoice is a business document that differs from a simple price quotation in that it is usually considered a binding agreement, despite the fact that, like a price quote, the terms of sale are subject to change.

#PROFORMA INVOICE SOFTWARE FREE DOWNLOAD PROFESSIONAL#

This free proforma invoice template offers you a blank proforma invoice form that you can use to create professional proforma invoices.

0 kommentar(er)

0 kommentar(er)